Questions? (800) 560-2242

Now is the time automate and secure your Accounts Payable process.

Benefits Of Outsourcing The Business Check Payment Process

From expanding marketing efforts to managing

employees, business owners have more than enough work to fill each day. Most

business owners and their workers spend too much time on administrative tasks.

With today's technologies, a considerable amount of these tasks can be

automated or outsourced to save money. This does not mean staff cuts. However,

outsourcing some tasks can give your administrative staff more time to focus on

important high-value activities and the accuracy of those tasks. Projects that

will improve customer relations, increase sales and improve internal processes

are easier to develop and execute if administrative workers are not overwhelmed

with tasks such as printing checks and juggling vendor account files.

In most cases, in-house bill payment consumes a considerable amount of time and

resources. The task of issuing checks to vendors for financial obligations can

cost a business much more money than it should. For companies that still rely

mostly on paper-based processes, this is especially true. Issuing payments and

analyzing bills may mean hours of sorting through files and crunching numbers.

By making payments electronically and outsourcing them, business owners save

themselves the hassles and high costs of outdated paper checks.

Expenses Of Using Checks

To better understand the time and money that

goes into using checks and why they are wasteful, think about what usually goes

into each check. These 15 steps are associated with the issuing process in most

cases:

1. Worker requests payment approval.

2. Worker reviews payment with approver.

3. Approver reviews payment request for any

issues and requests additional data.

4. Worker spends time finding files and adding

numbers.

5. Worker makes required payment adjustments.

6. Accounting manager reviews checks for

approval.

7. Worker sets up system for issuing checks.

8. Worker gathers paper supplies and prepares

the printer for printing checks.

9. Worker conducts test print to avoid errors

and then prints the actual checks.

10. Worker gathers signatures for the checks.

11. Accounting manager reviews checks for

possible errors.

12. Worker gathers documentation for any

discrepancies or issues.

13. Worker adjusts discrepancies and prints new

checks.

14. Worker puts checks into envelopes, add stamps and mails.

15. Worker sends positive pay file to the bank to

prevent check fraud.

When you factor in supplies and time, issuing a

check really costs you about $10.50. With an ACH automatic payment, you spend

about $0.50 instead. Since business owners and executives spend so much time

focusing on high-value tasks, they may not realize just how much time is wasted

on issuing paper checks. Also, the resources involved in issuing checks are

expensive. Printer ink, blank checks, envelopes and stamps are all expenses

that add up over the course of a year.

How Do Outsourced Payments Work?

With solutions offered from Advantage Business Equipment, all of your accounts payable can be paid electronically and automatically. Since our systems are cloud-based, they are always working for you no matter where you are. You have professionals helping with your accounts payable who take the responsibility of handling your finances seriously. Our platforms are efficient and gives your workforce more time to focus on high-value tasks at the workplace.

Benefits Of Electronic Outsourced Accounts Payable

As we mentioned earlier, the cost of printing

checks and using paper-based processes is expensive. You can save up to 80 percent

by using direct deposit instead of printing checks. These are some of the top blog benefits of using our cloud-based system with ACH payments:

- The transaction fees are considerably lower for ACH payments.

- ACH payments ensure instant payment for your vendors.

- You spend less on paper supplies and boast a green paperless solution.

- Recurring payments can be set up to be paid automatically.

- When vendors request checks, they can be issued for 80 percent less than in-house processing costs.

- The system stops fraud with positive pay file submission.

- There is full tracking and audit control.

- You can review and approve every payment before it is submitted.

- Remote check approval is available from anywhere in the world.

Have a look at our blank check stock finder category

Put an end to the expensive hassle of having

workers spend hours buried in files and paperwork, stuffing envelopes and chasing

down invoices from your vendors. Let us help you set up a seamless and

efficient system for making quick payments that are secure and always on time.

Our experienced professionals process over 90 billion in payments every year, and we want to help you experience the benefits of ACH payments through our new cloud-based system.

Contact us or visit ABE-Online.com to learn more.

Categories

Recent Posts

- Shredder Security Levels explained

- What Is A Shredder Used For In An Office?

- Which Is The Best Paper Shredder For A Small Office?

- PacMaster Cardboard Shredder / Packing Material Machine

- When is buying 2 commercial shredders cheaper than buying one?

- What are the rights of a business in the charge back process?

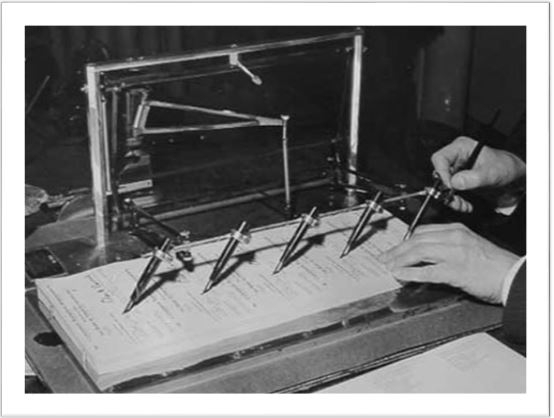

- Check signing software versus a check signing machine.

- How to choose the right check signing machine or software?

- How loud are paper shredders?

- Now is the time automate and secure your Accounts Payable process.

About

Advantage Business Equipment posts information to help businesses:

- Automate accounts payable procedures.

- Set up secure check signing software or machines.

- Research finding the correct shredder for offices or commercial businesses.

- Find the best 3D printer for businesses and schools.

- Finding the appropriate paper handling equipment for churches, mail rooms, and print shops.

- Build or find the right hard drive degausser, hard drive punch or shredder to protect confidential electronic data.

© Copyright 2025 Advantage Business Equipment. All rights reserved.